Turmoil in the Red Sea affecting world-wide container shipping

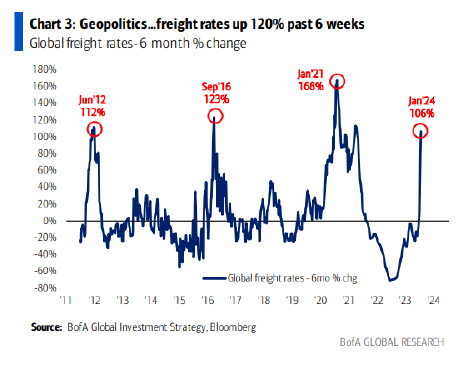

Container shipping rates for crucial global trade routes have surged due to concerns about prolonged disruptions in the Red Sea and inflation. The increase is linked to U.S. and UK airstrikes on Yemen, as fears grow over the impact on global trade in one of the busiest sea routes globally.

The airstrikes targeted Iran-backed Houthi forces in retaliation for attacks on Red Sea shipping, escalating the regional conflict that originated from Israel’s war in Gaza. Over the past month, Houthis have targeted vessels in support of Palestinians during the Israel-Hamas conflict, affecting at least 23 commercial ships since mid-November, according to Freightos Terminal.

Goldman Sachs analyst Patrick Creuset noted that rerouting vessels from Suez via the Cape due to recent attacks is significantly reducing available space on container ships. Depending on the duration of the disruption, it could lead to supply chain disruptions and higher transport costs, particularly in Asia-Europe trades.

Major players in the ocean shipping industry, handling over 90% of global trade, are preparing for months of cost-related challenges. Kuehne + Nagel’s Michael Aldwell anticipates that even if the Bab al-Mandeb Strait becomes safe, it will take at least two months before vessels return to normal rotational patterns.

To circumvent the Red Sea, major container ship owners are redirecting ships to the longer route around Africa’s Cape of Good Hope, adding approximately 10 days and $1 million in fuel costs for each one-way voyage between Asia and Europe.

This shift has caused delays in vessel schedules, leading to doubled rates on the most affected routes from a month ago, though still below the record highs during the pandemic. Major importers report product shortages or warn of late-arriving goods, with dry bulk being the least affected sector amid increasing tanker rates.

“Here at LA Foods, we are closely monitoring all supply chain disruptions,” said Larry Schwartz. “We’re using our 30+ years of experience to make sure our customers have what they need and when they need it.”